colorado springs sales tax online

ColoradoSpringsgov search Sales Tax If reporting use taxes on line 8 of this tax return please attach Schedule B use tax detail report or like schedule. Under 300 per month.

Covid 19 Response Colorado Springs

Has impacted many state nexus laws and sales tax collection requirements.

. Go to the Retail Delivery Fee web page for information on how to begin collecting and remitting. Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range. Sales Tax Sales Tax Important Notice The city of Glenwood Springs has partnered with MUNIRevs to provide an online business licensing and tax collection system.

Colorado Springs is in the following zip codes. City of Colorado Springs Sales and Use tax rate is 307 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected 513 List of all Colorado Home Rule CitiesCounties please go to wwwcoloradogovrevenue and search for DR 1002 What is sales tax. Wayfair Inc affect Colorado.

Sales tax returns may be filed quarterly. If you have more than one business location you must file a separate return in Revenue Online for each location. Ad Lookup Sales Tax Rates For Free.

Make the check or money order payable to the Colorado Department of Revenue. The combined amount was 825 broken out as followed. If you filed online or with a tax software and want to pay by check or money order.

The County sales tax rate is. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a local sales tax. If you collect less than 30000 per month in sales tax or owe less than 30000 per month in use tax you are required to file quarterly.

Welcome to the City of Colorado Springs. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. 80901 80902 80903.

City of Colorado Springs Sales and Use tax rate is 307 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected 513 List of all Colorado Home Rule CitiesCounties please go to wwwcoloradogovrevenue and search for DR 1002 What is sales tax. Colorado Springs expects to exempt the new state fee on deliveries from city sales tax. Colorado Springs CO Sales Tax Rate The current total local sales tax rate in Colorado Springs CO is 8200.

Sales tax returns may be filed annually. The 2018 United States Supreme Court decision in South Dakota v. As far as sales tax goes the zip code with the highest sales tax is 80901 and the zip code with the lowest sales tax is 80902.

Ad New State Sales Tax Registration. Within Colorado Springs there are around 51 zip codes with the most populous zip code being 80918. Write the Colorado Account Number CAN for the sales tax account on the check.

Your browser appears to have cookies disabled. The Colorado Springs Sales Tax is collected by. You have twenty 20 days to file your taxes.

Effective January 1 2021 the city tax rate has decreased to 307 for all transactions occurring on or after that date. 100s of Top Rated Local Professionals Waiting to Help You Today. Sales Tax Breakdown Colorado Springs Details Colorado Springs CO is in El Paso County.

If the due date falls on a non-business day the next business day will be the due date for that quarter. City of Colorado Springs Department 2408 Denver CO 80256-0001 Online Services instructions additional forms amended returns are available on our website. Did South Dakota v.

Cookies are required to use this site. Include the filing period dates and the words Sales Tax Return on the check. 15 or less per month.

This system allows businesses to access their accounts and submit tax returns and payments online. The Colorado sales tax rate is currently. Filing frequency is determined by the amount of sales tax collected monthly.

Access the MUNIRevs System Contact Us Kara Daniels Controller Email Phone. Sales Tax Filing and Payment Portal. The Colorado Springs sales tax rate is.

Colorado Dept Revenue Sales Tax information registration support. HB22-1406 allows qualifying retailers to claim a limited state sales tax special deduction under certain conditions and to retain the resulting state sales tax for sales made in July August. Interactive Tax Map Unlimited Use.

On June 29 2022 the Colorado Department of Revenue Division of Taxation adopted a temporary emergency rule to comply with a state or federal law. Colorado Springs CO 80903. Colorado Springs CO 80903.

The December 2020 total local sales tax rate was 8250. Use the tax return below for purchases on or after the effective date. The quarters are listed below these are fixed.

Download all Colorado sales tax rates by zip code. 312 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS. Colorado Springs is located within El Paso County Colorado.

Recent Colorado statutory changes require retailers to charge collect and remit a new fee. File Sales Tax Online There are a few ways to e-file sales tax returns. Annual returns are due January 20.

719 385-5291 Email Sales Tax Email Construction Sales Tax. Instructions for City of Colorado Springs Sales andor Use Tax Return 307 Sales and Use Tax Return 307 Sales and Use Tax Return in Spanish. 719 385-5291 Email Sales Tax Email Construction Sales Tax.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail sale delivered by motor vehicle to a location within Colorado. A full list of locations can be found below.

The 27 cent delivery fee that went into effect July 1.

Colorado Springs Diversity Grows Across City Hispanic Population Rapidly Expanding News Gazette Com

Cheap Flights From Phoenix Sky Harbor To Colorado Springs From 20 Phx Cos Kayak

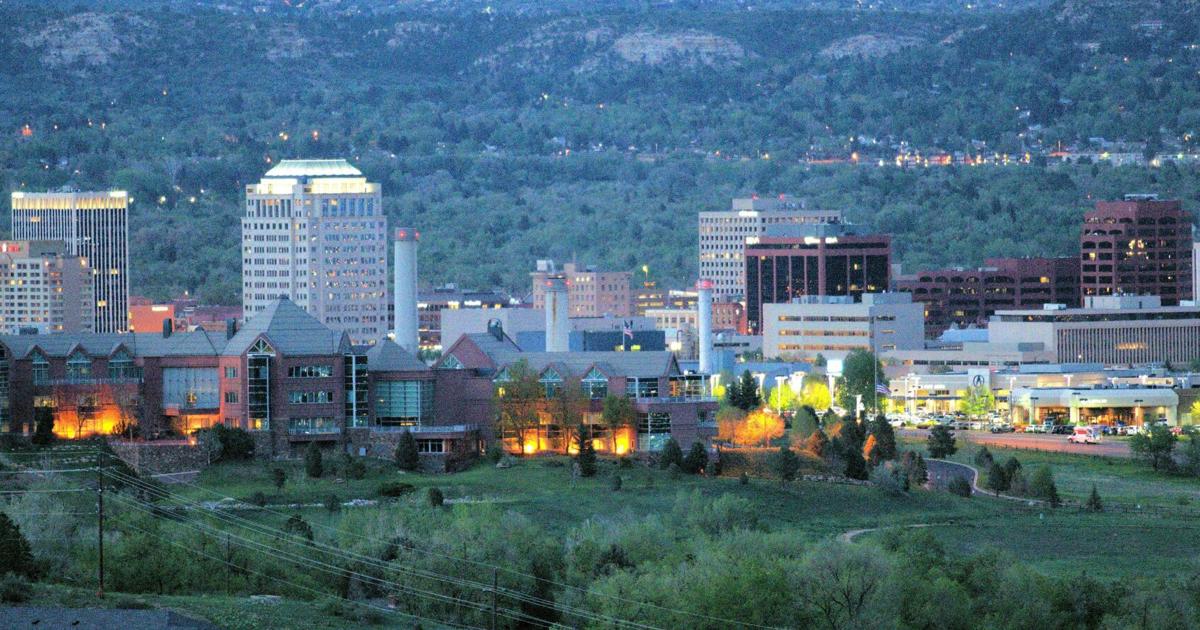

Colorado Springs Cost Of Living Colorado Springs Co Living Expenses Guide

Red Rocks South 8 000 Seat Outdoor Amphitheater Planned In North Colorado Springs Thetribune Gazette Com

Business Resources Colorado Springs

Colorado Springs Real Estate Colorado Springs Co Homes For Sale Zillow

Coleman Community Park Master Plan Colorado Springs

Traffic Cameras Colorado Springs

2020 City Council Redistricting Colorado Springs

Opportunity Zones Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

How To Pay State And Online Sales Taxes In 9 Steps Tax Mistakes Tax Deductions Tax

Colorado Springs Company Behind Planned Amphitheater Announces Next Move Subscriber Only Content Gazette Com

24 E Washington St Colorado Springs Co 80907 Colorado Springs Colorado Springs

New Downtown Parking Rates And Hours Go Into Effect Colorado Springs

Taxes In Colorado Springs Living Colorado Springs

Iconic Downtown Colorado Springs Hotel Gets New Owner Subscriber Only Content Gazette Com