ny paid family leave tax code

Each year the Department of Financial Services sets the employee contribution rate to match. For 2022 the SAWW is.

New York State Paid Family Leave Law Guardian

The New York Paid Family Leave NYPFL insurance tax requires New York employers to obtain an insurance policy or self-insured plan that is funded by employee.

. Beginning January 1 2018 employees may use paid family leave. Read Section 3559 - Paid family leave definitions NY. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

ProSeries Tax Discussions. Float this Topic for Current User. New York State Department of Labor - Unemployment nygov.

What Is Ny Paid Family Leave Tax. Mark Topic as Read. NY Paid Family Leave.

Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will. Pursuant to the Department of Tax Notice No. NY Paid Family Leave.

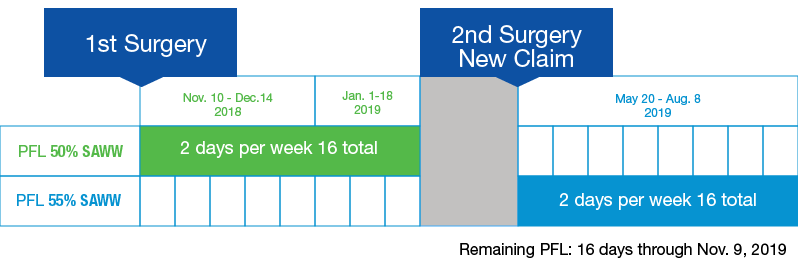

Employees earning less than the. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Mark Topic as New.

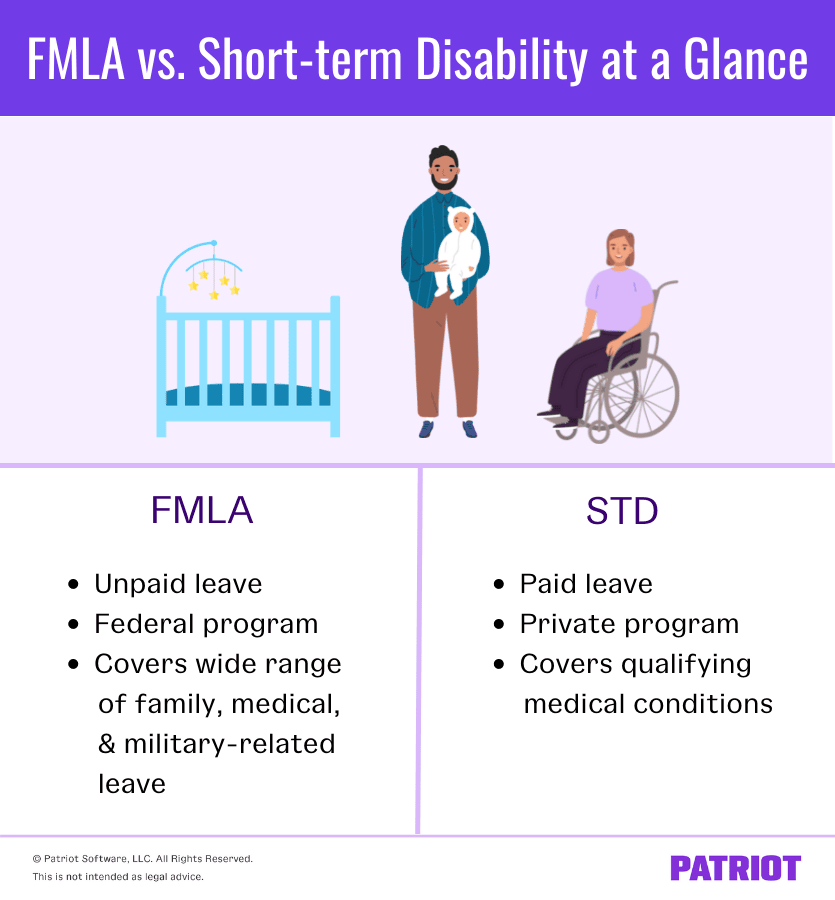

W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program. The New York State Paid Family Leave PFL law provides paid leave to employees for bonding leave including the birth of a child or leave related to adoption and foster care obligations. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages.

12 3559 see flags on bad law and search Casetexts comprehensive legal database. Use of NY Family Leave. They are however reportable as.

Ny paid family leave tax code Friday March 11 2022 Edit. As of January 1 2021 must provide up to 56. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Taxation Guidance Is Finally Here for NY Paid Family Leave August 31 2017 The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1. To bond with the employees child during the first 12 months after the childs birth or after the.

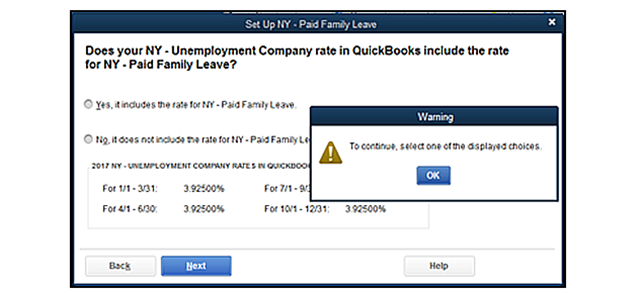

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

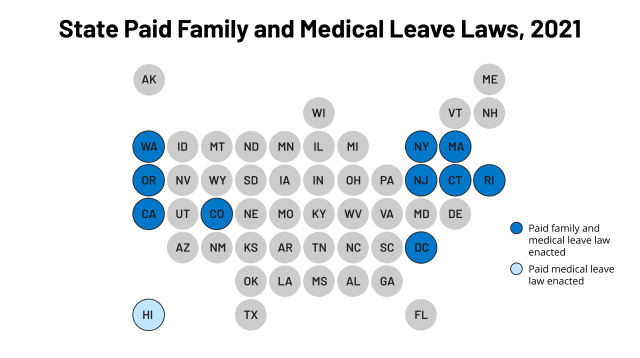

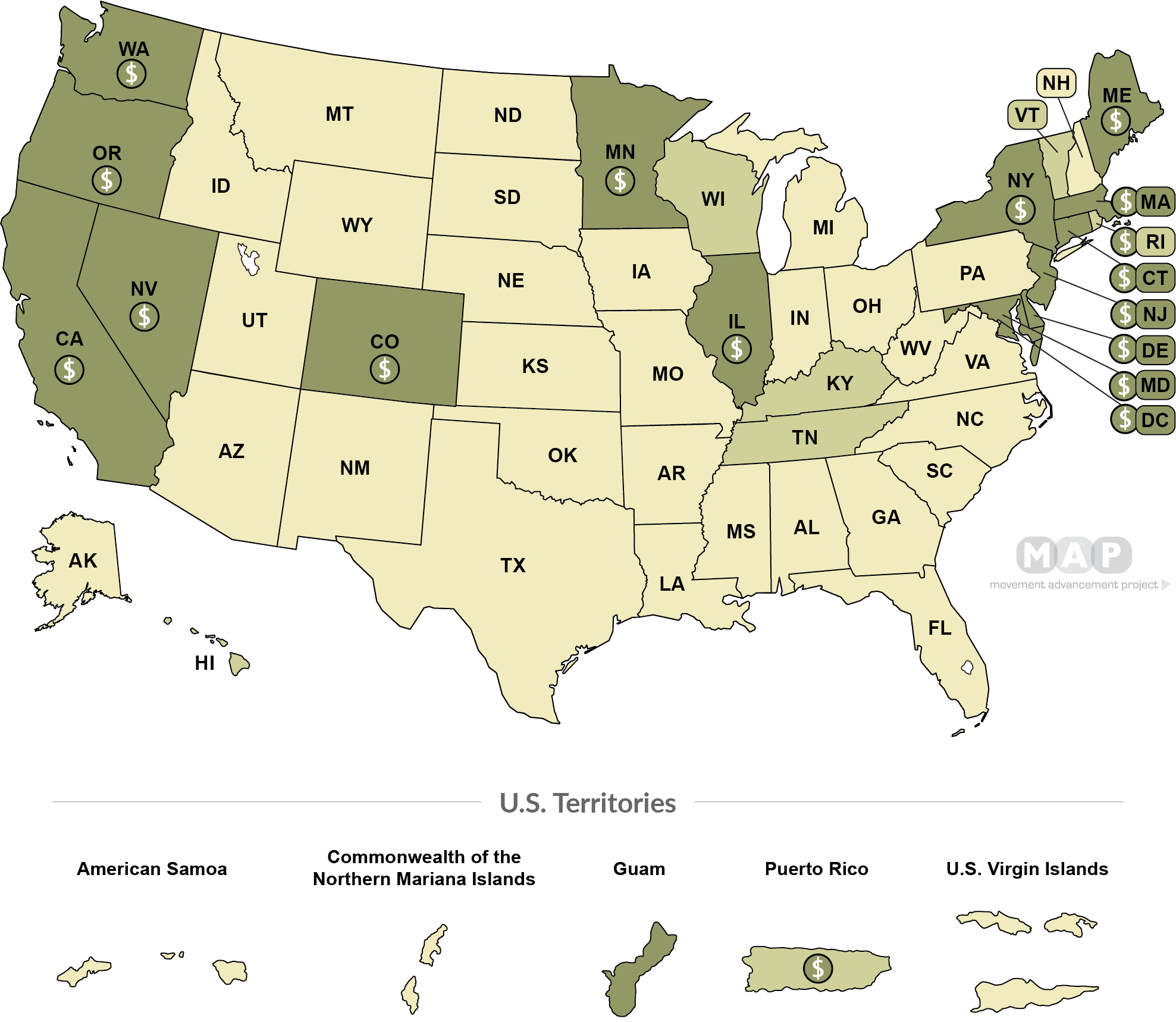

Paid Family Leave In The States

The Next Big Question On New York Paid Family Leave How Do We Determine Tax Obligations

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Movement Advancement Project Family Leave Laws

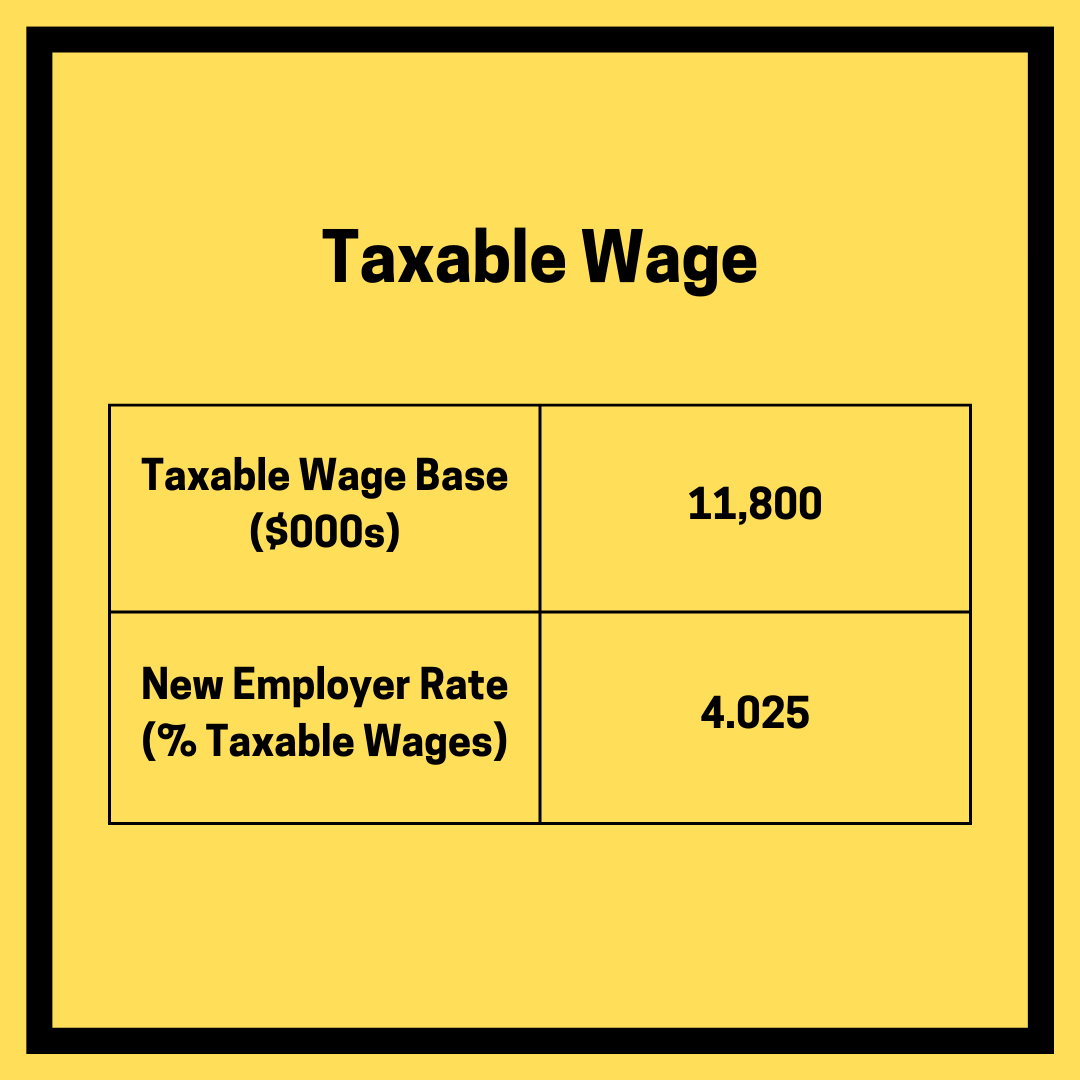

A Complete Guide To New York Payroll Taxes

Paid Family Leave For Family Care Paid Family Leave

New York Paid Family Leave Rates For 2021 Hr Works

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

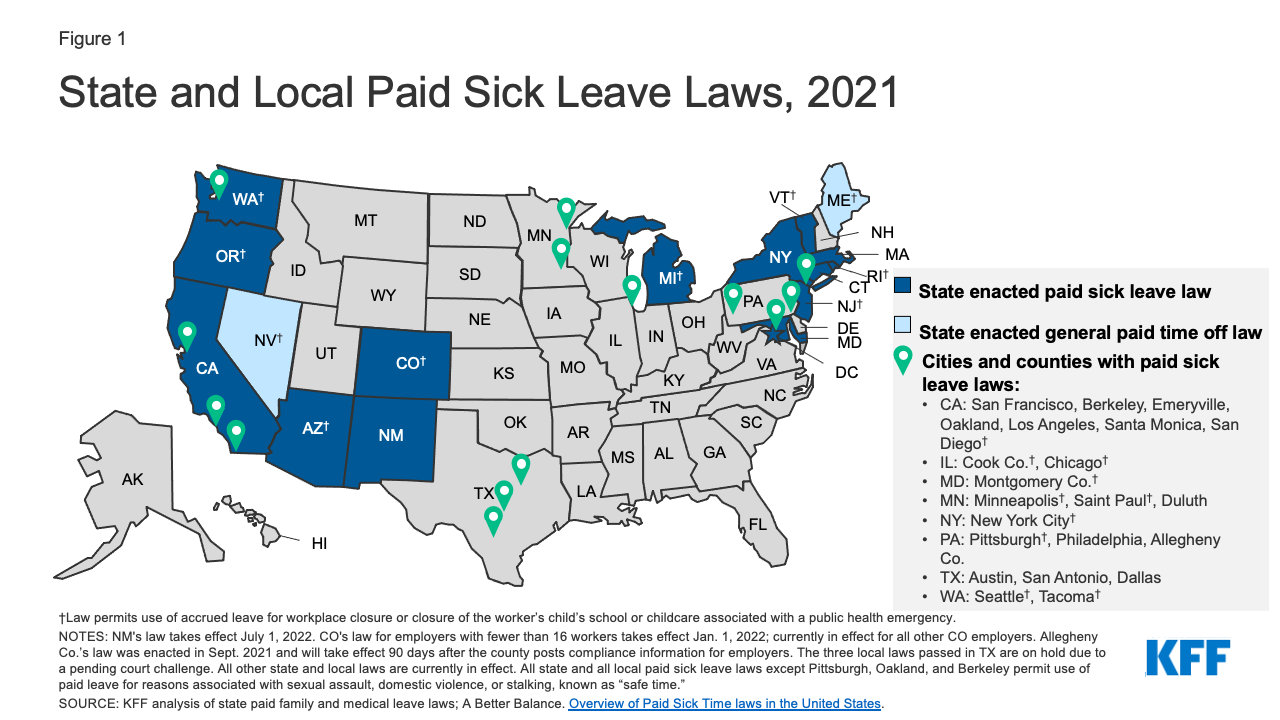

Paid Medical And Caregiving Leave During The Coronavirus Pandemic What They Are And Why They Matter Equitable Growth

6 Need To Knows About New York State Paid Family Leave Burr Consulting Llc

House Democrats Revive Paid Leave Program Ignoring Manchin S Concerns The New York Times

New York Employment Law Update Constangy Brooks Smith Prophete Llp

Ny State Paid Family Leave Benefits Law Ppt Download

New York Paid Family Leave 2021 Contributions And Benefits Schulman Insurance